Click on one of the following below to expand

Overview

Download the Powerpoint Here

Download the Powerpoint Transcript Here

Nonprofit organizations may find their missions are intensely impacted by partisan activities, including pending or active reforms, referendums, and elections. This presents § 501(c)(3) nonprofit organizations with a unique conflict, as IRC § 501(c)(3) prohibits these organizations from engaging in political campaign intervention or other enumerated electioneering related activities. Electioneering is the “participat[ion] or intervent[ion] in any political campaign on behalf of (or in opposition to) any candidate for public office.”

If you have questions regarding whether specific activities constitute electioneering, consult your attorney.

Treasury Restrictions

Download the Powerpoint Here

Download the Powerpoint Transcript Here

501(c)(3) nonprofit organizations must not engage in impermissible activities. If the organization impermissibly engages in electioneering based activities, the IRS may revoke the organization’s 501(c)(3) tax-exempt status.

Electioneering is the activity of trying to persuade constituents to vote for a particular political party or candidate. Nonprofits are prohibited from endorsing partisan broadcasts, official statements, or other communications and publications for or against a specific candidate, political expenditures, business activity related to candidates or elections, and official or unofficial candidate appearances. Additionally, any of these actions may violate the 501(c)(3) electioneering restrictions either as a prohibited action taken by the organization or as a violation on behalf of an individual managing an organization.

The Internal Revenue Service defines the electioneering restrictions mentioned above within IRC §1.501(c)(3)-1(c)(3) as follows:

(3) Authorization of legislative or political activities. An organization is not organized exclusively for one or more exempt purposes if its articles expressly empower it:

(i) To devote more than an insubstantial part of its activities to attempting to influence legislation by propaganda or otherwise; or

(ii) Directly or indirectly to participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of or in opposition to any candidate for public office; or

(iii) To have objectives and to engage in activities which characterize it as an action organization as defined in paragraph (c)(3) of this section.

Political Expenditures and Other Expenditures

Download the Powerpoint Here

Download the Powerpoint Transcript Here

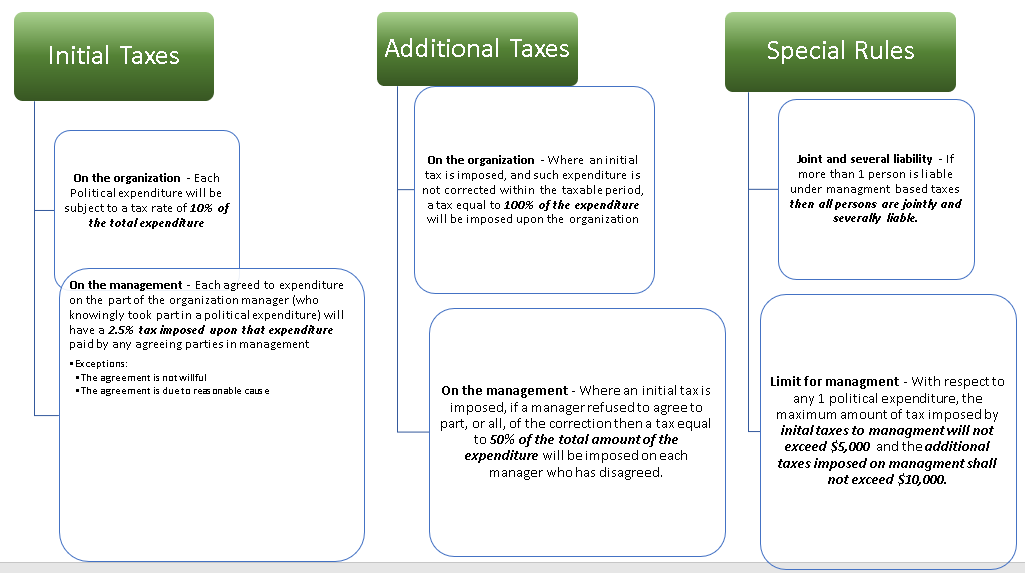

A political expenditure is defined as any amount that an organization pays or incurs through any participation or intervention in any political activity on behalf of or against a candidate for public office. Political expenditures include fees charged for speeches or appearances, the travel expenses of a candidate, expenses related to polls or studies, advertising, publicity, or fundraising for a candidate, or any expense which has the primary effect of benefiting a candidate. These expenses may incur taxes imposed on either the organization or the individual(s) engaging in these activities.

The following chart indicates the taxes imposed on the management and the organization, due to political and other included expenditures as defined by IRC § 4955:

Online Electioneering

Download the Powerpoint Here

Download the Powerpoint Transcript Here

The nonprofit industry has blossomed online, and more nonprofits than ever conduct official activities through the Internet. Tax-exempt organizations must be cautious when engaging in online activities as the organization may lose its status by engaging in impermissible online electioneering activates.

The online content that nonprofits create is a form of communication, and even more importantly so, it is a form of communication that is viewable by anyone who can access the Internet. Aside from the obvious advantages of an increased ability to network and fundraise, nonprofits also assume varying risks when adding certain content to their websites. Nonprofits must ensure it does not engage in any overt impermissible activities such as campaign intervention, partisan support or opposition, or other impermissible electioneering activities.

In order to do this, it is necessary to have careful and constant supervision of any third party-controlled content on its website. If one candidate’s campaign links are present on a 501(c)(3) nonprofit’s website, then all candidate’s campaign links must be equally represented. Links that are educational and informational are permissible as long as they are presented in an unbiased manner. To determine bias, the IRS will consider factors such as the directness of the link, the content of the link, any exempt purposes, which may have been served by the link, among other factors.

Issue Advocacy and Political Campaign Intervention

Download the Powerpoint Here

Download the Powerpoint Transcript Here

Under the IRC, section 501(c)(3) organizations cannot “participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office.” Violations may result in the denial or revocation of tax-exempt status, thus it is imperative to understand what actions give rise to an impermissible campaign intervention, as opposed to permissible issue advocacy.

Issue Advocacy is the “public support for or opposition to a particular cause or policy without a call to action on specific legislation (lobbying) or a candidate for elected office (political campaign intervention).” Campaign intervention, however, is a ban against political campaign activity (defined as “supporting or opposing a candidate for public office”) and 501(c)(3) organizations are barred from engaging in activities that give rise to a campaign intervention. Issue advocacy is separate from campaign intervention in that issue advocacy pertains to supporting or opposing legislative activities, which constitute a permissible activity for charitable nonprofits. 501(c)(3) organizations may take positions on public policy issues including on divisive issues, which differentiate candidates in an election for public office, but 501(c)(3) organizations must avoid any issue advocacy that function as a political campaign intervention by appearing to intervene on behalf of or in opposition to a particular candidate. Even where the statement does not expressly motivate an audience to vote for or against a specific candidate, organizations must take precautions to avoid engaging in political campaign intervention. When looking to whether an organization has engaged in behaviors giving rise to a campaign intervention, the IRS will assess the facts and circumstances of the context. Factors to determine if a statement is political campaign intervention include:

1. Whether the statement identifies one or more candidates for a given public office;

2. Whether the statement expresses approval or disapproval for one or more candidates’ positions and/or actions;

3. Whether the statement is delivered close in time to the election;

4. Whether the statement makes reference to voting or an election;

5. Whether the issue addressed in the communication has been raised as an issue distinguishing candidates for a given office;

6. Whether the communication is part of an ongoing series of communications by the organization on the same issue that is made independent of the timing of any election; and

7. Whether the timing of the communication and the identification of the candidate are related to a non-electoral event such as a scheduled vote on specific legislation by an officeholder who also happens to be a candidate.

Voter Education

Download the Powerpoint Here

Download the Powerpoint Transcript Here

501(c)(3) organizations are allowed to engage in voter education activities (“including the presentation of public forums and the publication of voter education guides”) where such conduct is performed in a non-partisan manner. 501(c)(3) organizations are also permitted to conduct voter registration drives and get out the vote (“GOTV”) events, so long as the drives and events are non-partisan. Where voter education or registration drives are conducted in a partisan (biased) manner that favors or opposes one or more candidates, such acts are prohibited and the organization’s non-profit tax status can be revoked.

Candidate Forums:

Hosting a public forum or debate is a permissible activity involving voter education. A forum for candidates is permissible where the questioning and format of the event does not demonstrate partisanship, nor does it favor or oppose a specific candidate. The forum must provide an objective and impartial treatment of the candidates and must not seek to bolster or advance the candidacy of one candidate over another.

When inviting several candidates for the same office or offices to speak at a forum, the 501(c)(3) should consider the following factors:

1. “Whether questions for the candidate are prepared and presented by an independent nonpartisan panel;

2. Whether the topics discussed by the candidates cover a broad range of issues that the candidates would address if elected to the office sought and are of interest to the public;

3. Whether each candidate is given an equal opportunity to present his or her view on the issues discussed;

4. Whether the candidates are asked to agree or disagree with positions, agendas, platforms or statements of the organization; and

5. Whether a moderator comments on the questions or otherwise implies approval or disapproval of the candidates.”

Voter Guides:

Voter guides are documents, generally presented as a chart in a pamphlet or in other short documents (such as mailers) that are intended to assist voters in comparing candidates’ positions on varying issues. These guides are generally viewed as a voter education tools so long as they do not indicate a preference for a candidate through the use of biased formatting, biased content within the guide, or through prejudicial distribution.

Individual Activity by Organization Leaders

Download the Powerpoint Here

Download the Powerpoint Transcript Here

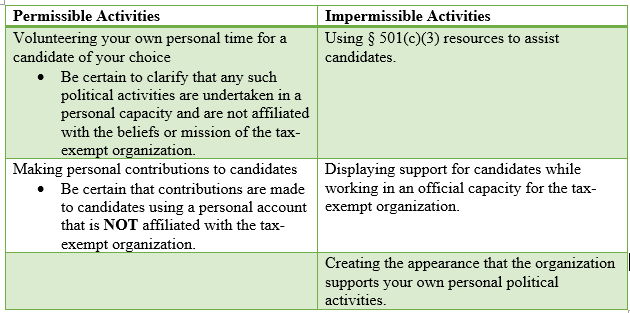

The restrictions on political campaign interventions are not intended to constrain free expression on political matters by the organization’s leaders (including employees, officers, and other recognizable agents), where such leaders speak for themselves instead of on behalf of their affiliated organization. As such, leaders of organizations are permitted to speak on their own behalf as individuals and are not barred from speaking about important issues of public policy. Leaders, however, are not permitted to make biased comments while acting in their official capacity, through official publications offered by the organization, or at official functions hosted or sponsored by the organization. In engaging in partisan activity, to preserve the tax-exempt status of the organization, the leader of an organization must clearly denote that their comments are being made in a personal capacity and are not affiliated with the view or opinion of their affiliated organization.

Individual Activity by Organization Leaders: Example

Download the Powerpoint Here

Download the Powerpoint Transcript Here

Coalition and Partnership Activities

Download the Powerpoint Here

Download the Powerpoint Transcript Here

Nonprofit organizations “may join a coalition composed of [section] 501(c)(3)s and [section] 501(c)(4)s for any purpose consistent with its exempt status, such as conducting research or preparing and publicizing materials on a current issue…. [or to] lobby on issues.” A 501(c)(3) tax-exempt organization may not engage in activities that would otherwise be impermissible indirectly through involvement in a coalition. Permissible activities of a coalition include conducting voter registration drives, advancing voter education initiatives and get-out-the-vote activities, if, and only if, these activities are conducted in a non-partisan manner.

If a coalition seeks to be “active on an ongoing basis, it may choose to incorporate or organize as an unincorporated association.” Despite the ability to incorporate, many organizations choose to “operate informally under a variety of arrangements.” The coalition members may agree to “plan joint or common activities with each of the participants paying its own expenses.” The coalition members may also elect one of the partners to act as the sponsor of the coalition. “Under this structure… [a]ll of the coalition’s activities paid for by the sponsor (including lobbying activities) would be considered activities of the sponsor and would be reported on its information return (Form 990) to the IRS.” As such, § 501(c)(3) organizations may not be a viable option in sponsoring a coalition’s that may engage in otherwise impermissible electioneering efforts.

Precautions

• Maintain power over meetings with coalition members

Where meetings include members with varying tax statuses, circulate agendas in advance and obey the agendas. Permit members to exit when the meeting content shifts to materials that are inappropriate per the respective tax-exempt organization’s limitations.

• Maintain control over the use of the coalition’s website

Create an agreement pertaining to the structure of website, what content may be displayed, and who will maintain the website.

Candidate Appearances

Download the Powerpoint Here

Download the Powerpoint Transcript Here

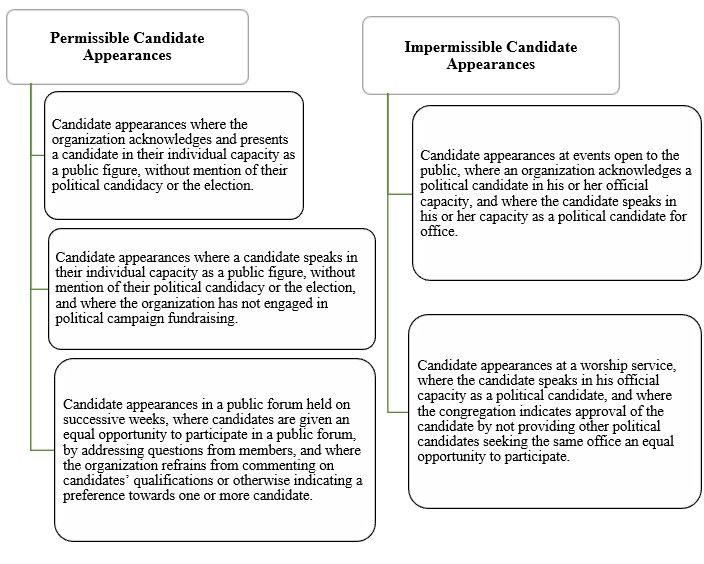

501(c)(3) organizations are expressly prohibited from participating or intervening in any political campaign on behalf of, or in opposition to any candidate for public office. Strict adherence to this prohibition is required for a section 501(c)(3) organization to avoid jeopardizing their tax-exempt status. When conducted in a nonpartisan manner—some electioneering activity is permissible. In Revenue Ruling 2007-41, the Internal Revenue Service provides specific guidelines and examples used to determine whether a Section 501(c)(3) organization has engaged in permissible or impermissible electioneering activity. Whether a political candidate’s appearance is permissible or impermissible depends on all the “facts and circumstances,” as specified in Revenue Ruling 2007-41.

A 501(c)(3) organization may host a political candidate appearance during an election season to promote voter education, public participation in the political process, or to generate support for the organization’s particular initiative. Political candidates may be invited to appear at an organization-sponsored event in either their official capacity, as a candidate for public office, or in their unofficial capacity as a public figure. A candidate’s appearance at an organization-sponsored event does not itself constitute a political campaign intervention, unless the candidate is “publicly recognized by the organization, the candidate is invited to speak,” or otherwise considered to be engaging in a political campaign intervention,” under the factors articulated in the Revenue Ruling 2007-41 by the IRS.

Unofficial v. Official Capacity

Download the Powerpoint Here

Download the Powerpoint Transcript Here

A nonprofit organization may decide to host a political candidate at a sponsored event to generate support for a cause or to promote voter education. When an organization decides to invite a candidate to appear at an event, the organization may invite the nominee to speak in their official capacity, as a candidate for public office, or in their unofficial capacity, as a public figure. The following factors, from the IRS Revenue Ruling 2007-41, are considered in determining whether the organization’s activities constitute prohibited participation or intervention in a political campaign:

1. Whether the organization provides candidates seeking the same office an equal opportunity to participate;

2. Whether the organization indicates any support for or in opposition to the candidate (including candidate introductions and communications concerning the candidate’s attendance);

3. Whether the organization is engaged in any political fundraising.

Candidate Appearances in their Official Capacity

According to Revenue Ruling 2007-41, whether a section 501(c)(3) has “provide[d] candidates seeking the same office each an equal opportunity to participate” in an organization-sponsored event is determined by considering the nature of the event to which each candidate is invited, and the manner in which each candidate is presented at the event. Candidate introductions and communications to the public regarding a candidate’s appearance at an event must be comparable, while sponsoring or opposing a particular candidate at an event is strictly prohibited and automatically constitutes a political campaign intervention. Any form of political fundraising at an organization-sponsored event also constitutes a political campaign intervention, under the regulations set forth by the IRS. The following factors of the Revenue Ruling 2007-41 are considered in determining whether the activity constitutes a political campaign intervention:

1. Whether questions for the candidate are prepared and presented by an independent nonpartisan panel;

2. Whether the topics discussed by the candidates cover a broad range of issues that the candidates would address if elected to the office sought and are of interest to the public;

3. Whether each candidate is given an equal opportunity to present his or her view on the issues discussed;

4. Whether the candidate is asked to agree or disagree with positions, agendas, platforms or statements of the organization; and

5. Whether a moderator comments on the questions or otherwise implying approval or disapproval of the candidates.

When a 501(c)(3) organization decides to only invite one candidate to speak at a general meeting, it will be doing so in violation of the political campaign prohibition, even if the manner in which speakers are presented is otherwise neutral.

Candidate Appearances in their Unofficial Capacity

A candidate appearing at an organization’s event in their unofficial capacity appears or speaks in their individual capacity as a public figure. A political candidate may appear in their unofficial capacity as a public figure “that currently holds, or formerly held, public office; a public figure considered to be an expert in a non-political field; or one who is a celebrity, or has led a distinguished military, legal, or public service career.” Candidates may also choose to attend events open to the general public, including “lectures, concerts, or a worship service.” A candidate’s appearance at an organization’s event does not itself meet the threshold constituting a political campaign intervention, unless the candidate is publicly recognized by the organization; the candidate is invited to speak, or otherwise considered to be political campaign intervention under the following factors:

1. Whether the individual is chosen to speak solely for reasons other than candidacy for public office;

2. Whether the individual speaks only in non-candidate capacity;

3. Whether either the individuals or any representative of the organization makes any mention of his or her candidacy or the election;

4. Whether the organization maintains a nonpartisan atmosphere on the premises or at the event where the candidate is present; and

5. Whether the organization clearly indicates the capacity in which the candidate is appearing and should not mention the individual’s political candidacy or the upcoming election in the communications announcing the candidate’s attendance at the event.

Unofficial v. Official Capacity Example

Download the Powerpoint Here

Download the Powerpoint Transcript Here

Business Activity

Download the Powerpoint Here

Download the Powerpoint Transcript Here

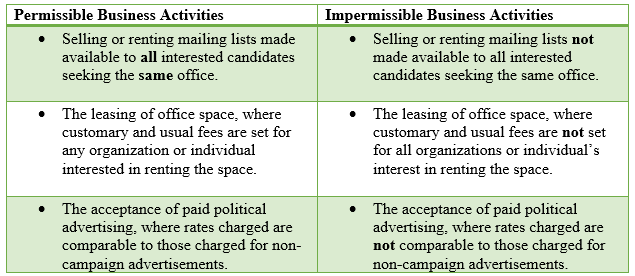

Under the Internal Revenue Code, section 501(c)(3) organizations are generally limited in the types of business activity they are permitted to conduct. The violation of this regulation may result in the revocation of an organization’s tax-exempt status under section 501(c)(3). During the course of an organization’s business activity, a question may arise of whether such activity constitutes participation or intervention in a political campaign. The factors, from Revenue Ruling 2007-41, in determining whether an organization’s business activity constitutes political campaign intervention are as follows:

1. Whether the good, service or facility is available to candidates in the same election on an equal basis,

2. Whether the good, service, or facility is available only to candidates and not to the general public,

3. Whether the fees charged to candidates are at the organization’s customary and usual rates, and

4. Whether the activity is an ongoing activity of the organization or whether it is conducted only for a particular candidate.

Examples of Business Activities

Download the Powerpoint Here

Download the Powerpoint Transcript Here